As we reported last October, the Inflation Reduction Act allows a tax credit for registered clean fuel production beginning January 1, 2025. Eligible clean fuels include Low-GHG natural gas, which refers to natural gas that produces a relatively low amount of greenhouse gas emissions, including Renewable Natural Gas (RNG). Also known as 45Z credits in the accounting world, these credits are transferable for cash, so even companies without taxable income can benefit by selling them at a modest discount on the open market. This is an annual tax credit, and based on current tax law, can be claimed for 2025, 2026 and 2027.

To qualify for the tax credit, the taxpayer must be registered in the United States for clean fuel production, and the RNG must meet the specifications of ASTM D8080-21. Submittal of a form addresses registration, and compliance with ASTM D8080-21 requires a third party, such as Ohio Lumex, to come onsite, and sample and analyze the gas in accordance with approved test methods for each specified analyte. While most of the required tests are typically required by RNG gas quality specifications, Maximum Particulates and Compressor Oil are unique to ASTM D8080-21, as this was meant for vehicle fuel. For Maximum Particulates, ASTM D7651 is required, and that was originally written for Hydrogen Fuel, but has been adopted here. For Compressor Oil, ASTM Work Item WK49305, is required, and that method has since been published by ASTM as D8251.

Ohio Lumex Performs ASTM D8080-21

Ohio Lumex has been supporting our clients over the last several months with both sampling and laboratory analysis to certify that they meet the specifications required by ASTM D8080-21. Our team of certified Field Service Technicians come onsite to perform the sampling to the required methods, and our accredited analytical laboratory conducts the analyses and issues the Certificates of Analysis that companies will need to submit for compliance.

Navigating the Process

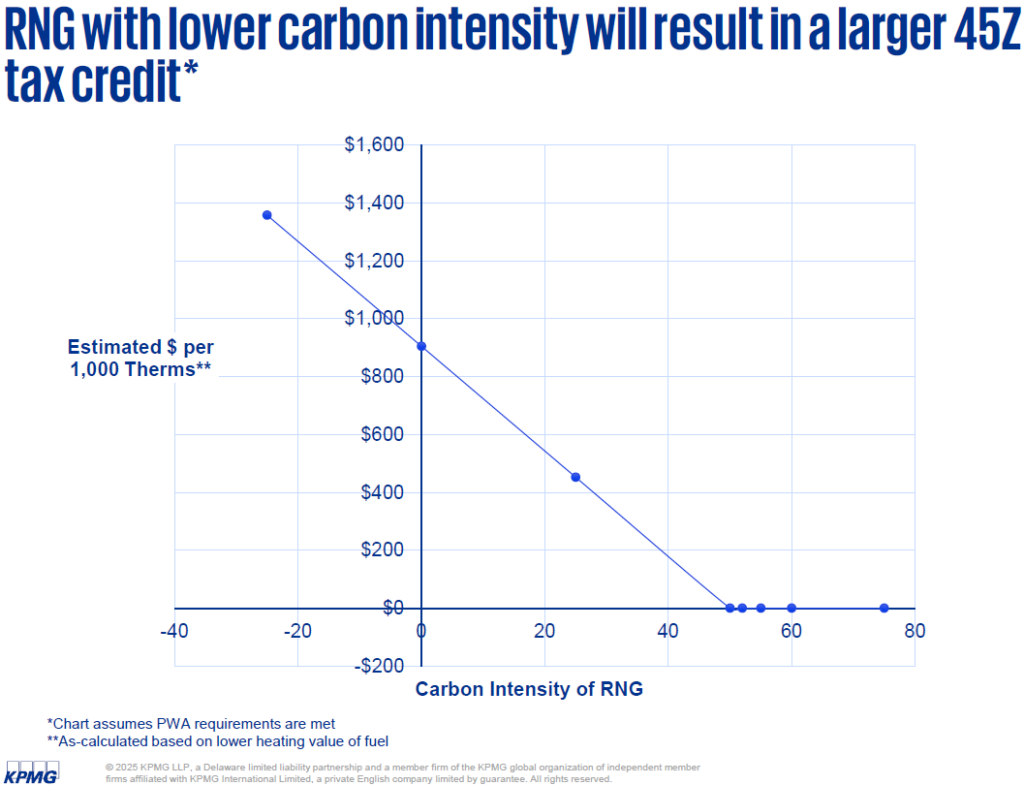

We have been receiving numerous calls from producers asking for more information on the process, including registration, eligibility, calculation of tax credits, etc. One of the best resources we have found is KPMG. They are very knowledgeable on the topic and have been heavily involved in advising the industry on tax issues. At our request, they drafted a short presentation (available here) to address some of the frequently asked questions.